About this course

Enable your engineers to make data-driven and financially founded decisions about your assets. Help them to “speak finance” by calculating the life cycle costs of different asset options, quantify the value of improvement projects and compile a sound business case to substantiate their recommendations.

One of the biggest frustrations for engineers is the need to motivate and justify their ideas and decisions in financial terms to get funding. They are often confused by the financial jargon and paralysed by their inability to convert a technical solution into a financially viable one.

Pragma has developed a training course to address this specific need in a highly practical way. It explains complex principles such as life cycle costing, equivalent annual cost and ROI in a logical way and life cycle through real-life case studies.

Pragma has combined its 30 years of asset management experience with the expertise of some of our blue-chip clients to develop a unique training programme that gives engineers the competence and confidence to make data-driven and financially based asset management decisions.

Outcomes

Identify the need to support decision-making with good financials which considers the full life cycle of the asset

Compile the various Financial elements for a business case to motivate or justify an improvement project

To recognise and be able to use financial modelling, with sensitivity analysis and even scenario planning to inform decision-making

Categorise and quantify the value of an improvement project

Explain and use financial terms like the time value of money, return on investment and sunk costs

Use life cycle cost (LCC) principles to calculate net present value (NPV) and the equivalent annual cost (EAC) of an asset

Use LCC principles to inform asset acquisition decisions, to determine the optimum replacement cycle of an asset type (critical for budgeting), to motivate repair and refurbishment options, to inform end-of-life replacement decisions and to select the optimum asset tactics

Introduction to Asset Life Cycle Management

- Define asset management in terms of the value of assets.

- Describe the life cycle of assets.

- Explain the decisions that need to be made during the different stages of the asset life cycle.

- Explain the decisions that need to be made to optimise an asset portfolio.

- Describe the role of the reliability engineer during these decisions.

Financial Concepts and Modelling

- Explain the purpose and process of sensitivity analysis during decision-making.

- Explain the difference between fixed and variable costs and their influence on decision-making models.

- Explain opportunity cost and how it affects decision-making.

- Recognise and explain the purpose of the three main accounting statements and the purpose of depreciation.

- Understand basic terminology used around financial modelling.

- Be ready to apply financial modelling concepts to the rest of the course.

Life Cycle Costing

- Explain the time value of money.

- Explain the discount rates used during these calculations.

- Convert future and past cash flows to a net present value (NPV).

- Explain the items to be included in an asset’s life cycle costs (LCC).

- Explain what is meant by an asset’s equivalent annual cost (EAC).

- Calculate the LCC and EAC of an asset.

Using LCC for Asset Decision-making

- Understand the five main ways in which LCC can support asset decision-making.

- Support asset acquisition decisions with LCC analysis.

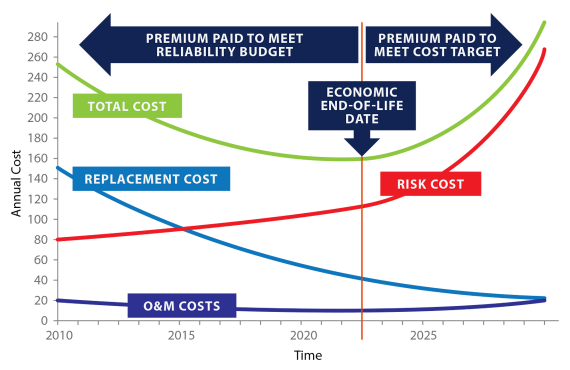

- Calculate the optimum economic life of an asset.

- Explain the logic behind the challenger-defender concept.

- Support end-of-life decisions on assets in terms of keeping them for one more year, or investigating whether refurbishment/repair are justified, using LCC analysis.

- Apply financial modelling to asset tactics decisions.

Quantifying the Value of Improvements

- Explain why we need to quantify the value of an improvement.

- Classify the value of an improvement according to the value model.

- Quantify the value of an improvement that increases throughout.

- Quantify the value of an improvement that reduces costs.

- Quantify the value of an improvement that reduces financing costs.

- Quantify the value of an improvement that avoids unexpected losses.

Compiling a Business Case

- Explain the objectives of a business case.

- Describe the ideal structure of a business case to achieve these objectives.

- Select appropriate indicators to quantify the benefit of the proposed project or improvement.

- Compile a compelling business case to motivate or justify an improvement project.

Competence Assessment

After the training, learners will be assessed through a knowledge review quiz and a practical assignment to create a business case for a new project.

Who should attend?

- Technical managers

- Reliability engineers

- Engineering managers

- Maintenance engineers

- Continuous improvement engineers

Format and duration

- 3-day classroom training

- 24 notional hours blended learning over six weeks

Take-home tools

- Excel templates to calculate LCC and EAC

- Excel templates to facilitate the financial decision-making process

- Template for a business case

Certification

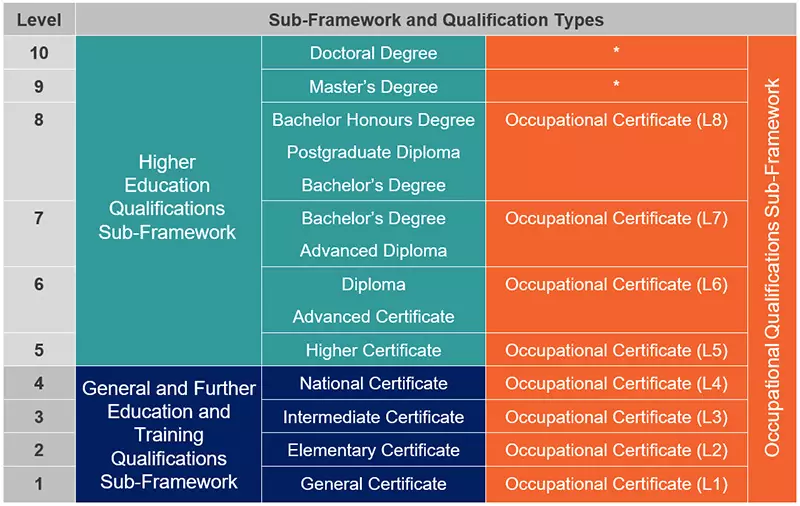

- ECSA endorsed for 3 CPD points