The Reatile Group, an investment holding company, has acquired a 37.54% stake in Pragma, one of SA’s leading enterprise asset and facilities management companies. This move enhances Pragma’s potential international growth, while accelerating the organisation’s transformation agenda.

“I’ve been involved with Pragma for a while, and I’ve known Reatile for much longer. I believe it’s a great move forward for both companies. I think what’s important is that it’s a very sound business decision based on normal business principles and creates a good platform for growth for both Pragma and Reatile. It will increase the business footprint in the energy sector in South Africa, but beyond that, this deal also accelerates Pragma’s South African transformation agenda and enhances the potential for international growth,” says Marjo Louw, Pragma Chairman.

Pragma CEO and founder Adriaan Scheeres, adds that the transaction results in 54.33% black ownership for Pragma Africa. “This is an important step in our transformation journey and we believe it will significantly strengthen our go-to-market positioning. Our new shareholders will open up new growth opportunities for us through their extensive business network, starting with services in the oil and gas sector, where Reatile is a major player. As one of my mentors always said, ‘One plus one must make eleven’. So how are we going to make eleven? This partnership will bring new opportunities and open up new avenues for growth. From an international perspective, Reatile is also active in the European market and will offer opportunities to work with organisations such as Vopak.”

According to Simphiwe Mehlomakulu, Chairman of Reatile, their company is invested in the energy, petroleum, chemical as well as the industrial space. “Pragma offers us the opportunity to fully develop the industrial aspects of our business. We are quite diverse and focused within those areas, and we cover a value chain across the sectors that we operate in. Pragma has proven itself in the field of physical asset management. It offers excellent capability and technology and is very client-centric. We believe that with our competencies we offer excellent value to Pragma and in turn can benefit from Pragma’s technologies.”

He continues that Reatile already works with many international companies such as Vopak and Rubis. “There are many opportunities to work with our international partners, also on the PPG side, which will enable Pragma to grow internationally. For example, Rubis operates in the Caribbean, France, and North Africa and has diverse assets. Pragma can add much value to their business. I think if you look at our economy, the future leaders in our country will need to be quite diverse. Our partnership and level of competence allows Pragma to reach more clients. Furthermore, our focus is to grow into Africa, which currently has a huge shortage of skills. We can provide the physical assets, which Pragma can manage as we grow.”

Scheeres continues that all parties agreed that the new board will play a major role in the company’s vision for the future. “Although Pragma will remain a separate business which will continue to develop its own competencies and run with that, Reatile’s leadership in the oil and gas industries is really going to strengthen our company and stimulate growth.”

From a Reatile point of view as the single largest shareholder in Pragma today, their philosophy is simple. Mehlomakulu explains: “We invest in businesses that have competent management and people. We want everyone at Pragma to join forces with us to help grow the company. We’ll support Adriaan with his vision, at a strategic level in terms of sector involvement as well as capital allocation. We can introduce leads, but it will still be up to Pragma to secure those and deliver on their promise. We won’t be interfering with the day-to-day running of the business. We invested in Pragma precisely because we like the way they do business.”

Scheeres believes that the two companies share many commonalities. “We’re both invested in our people and in creating value for our clients. We also both believe that everything we do should be above board and legal, which are the fundamentals on which we built our businesses. I think the one thing that we also have in common is the can-do attitude. We share the same values and culture to build an organisation that can be listed on the JSE and become a flagship in our country.”

Mehlomakulu agrees. “We’re entrepreneurs and believe everything that we do, should be done efficiently and meet our clients’ needs. We also believe our employees need to be looked after because satisfied employees are productive employees. As with Pragma, we really put a lot of effort into the training and development of our employees. We offer wellness programmes as well as bursary schemes for those who want to further their studies. We celebrated 15 years in business last year without taking shortcuts or compromising our integrity. Everything we do is for the sustainable, long-term future benefit of the country, our company and staff.”

Scheeres concludes: “We’ve been working very hard to make our business relevant today and in the future.

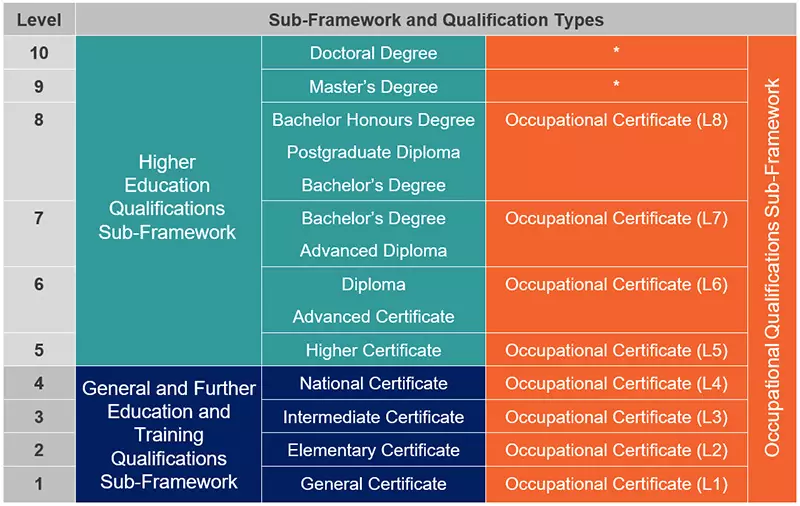

Pragma Africa was awarded a Level 1 BBBEE rating in December, which placed us in a very competitive position in the market, and we want to thank every individual who contributed endless hours towards this success. This transaction is the icing on the cake! It makes sense for both organisations, and we’re excitedly looking towards the future – new partners, new combinations and new opportunities.”