Andre Jordaan, Partner Consultant

Introduction

Many organisations discover that they have two or more duplicate asset registers when they take a good look at their practices and systems. This conundrum of multiple asset registers also surfaces during new system implementation or asset or infrastructure management intervention. This is especially true for the public sector, where four or more asset registers are typically found. We find that the problem also goes beyond the number of asset registers because the definition and boundaries of assets are blurred.

In this discussion we’ll unpack this phenomenon and give some guidance on it. We will use ISO 55010 as a leading source and focus on the equipment and financial asset registers, the departments that use them and how they can be aligned.

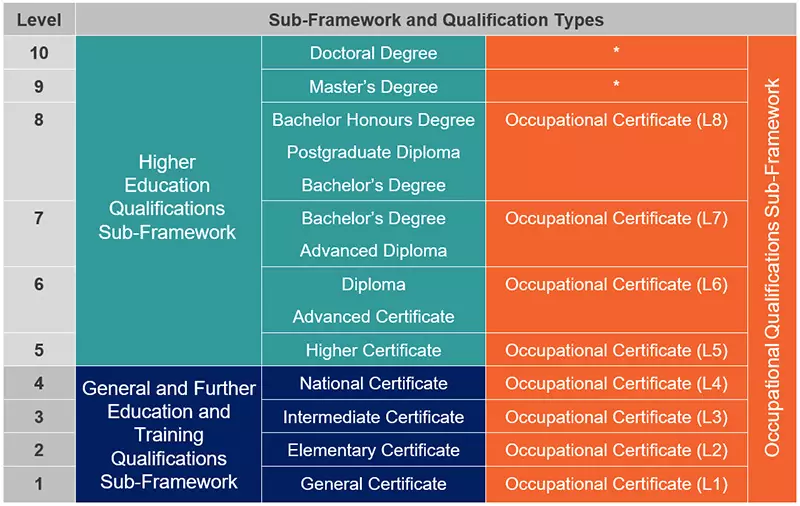

Definitions

Although words give meaning, they can also be confusing. With an array of specialists using the term ‘asset management’, it is not always clear what they are referring to – financial or engineering assets. Are you trading in shares for clients, or are you managing your company’s physical assets? Because it’s not clear, people add descriptors like ‘physical’ or ‘infrastructure’ to denote the engineering approach to asset management. Infrastructure asset management focuses on managing public infrastructure assets such as water treatment facilities, sewer lines, roads, utility grids, bridges and railways. Many of the participants who developed ISO 5500X were from public enterprises, and they included all kinds of assets in the definition, framework and knowledge created by it.

Physical or infrastructure asset management enables an organisation to realise value from its assets to achieve its organisational objectives. Assets are viewed as something that has potential or actual value for an organisation. The organisation uses an asset management system to direct, coordinate and control asset management activities (ISO 55002, 2018).

Building blocks for managing infrastructure

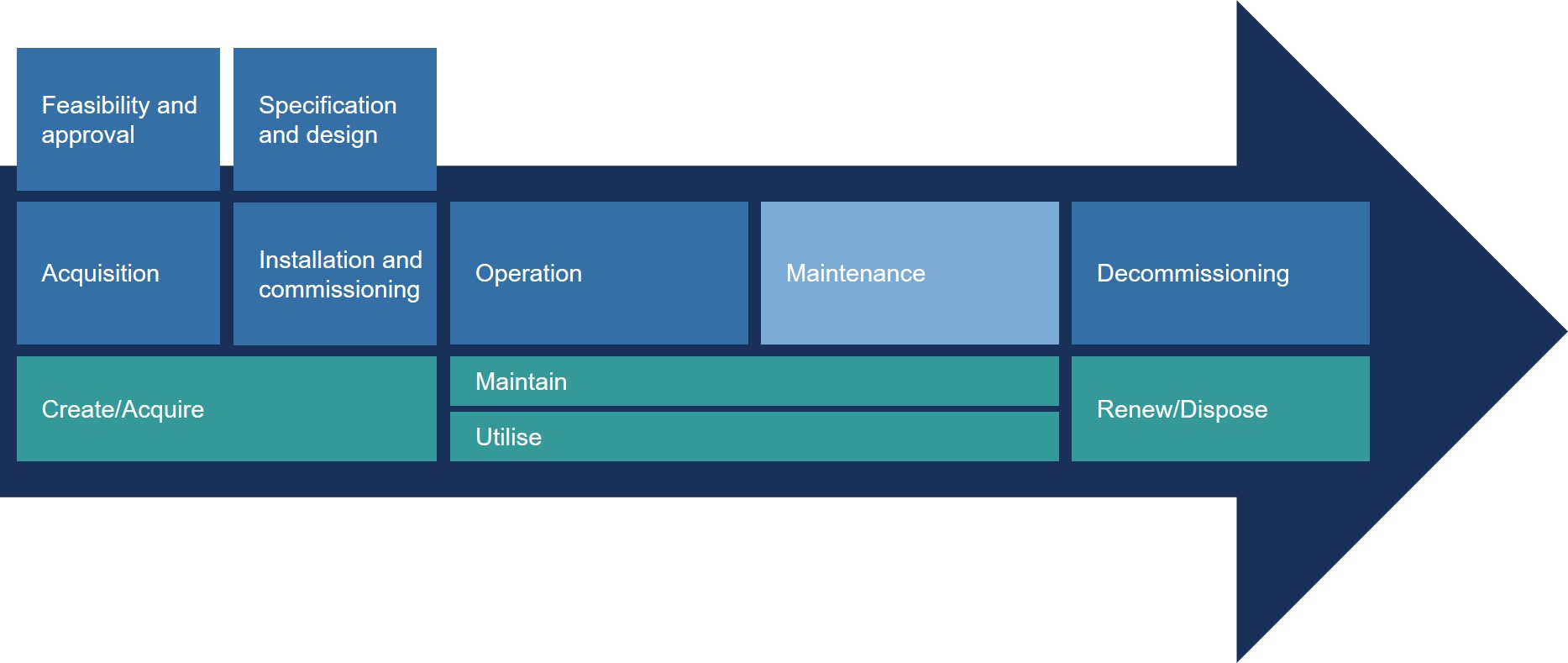

In infrastructure asset management, the focus is on managing the assets through their lifecycle while always supporting the organisation in reaching its goal. Operating and maintaining assets without supporting organisational goals can subtract rather than add value. To achieve this, the critical requirement in each of the four main phases of the asset life cycle must be met.

These are the four phases and their critical requirements:

- Create/acquire | You ensure that the demand is well understood (especially long term). The specified asset must be fit for purpose, and the operations and maintenance teams must be ready to use and maintain the asset once it is commissioned.

- Maintain | You have all the staff, systems, tools, facilities, etc in place to maintain the asset while continually evaluating the condition and performance against the asset management plan to know when to refurbish or dispose of it.

- Utilise | You ensure that the asset is operated optimally within design specifications and supports the organisation’s goals. A road that takes on heavier trucks than specified has a much shorter life than planned.

- Renew/dispose | You ensure that assets are safely disposed of while realising each asset’s maximum value.

Apart from these high-level lifecycle conditions, all the supporting functions like HR, Finance, IT, etc need to be considered for any successful and sustainable management system. All of this must be done while maintaining the optimal balance between performance, cost and risk.

Many things need to be in place to manage infrastructure well. One of the most foundational supporting elements is the asset register, sometimes called the equipment register or technical register. It is in the enterprise asset management system (EAMS) or computerised maintenance management system (CMMS), supporting a myriad of functions and processes. Maintenance plans run against specific assets, work orders are created against assets, and operating expenses and capital might be budgeted and tracked against assets or asset types/functional locations.

Different stakeholders, requirements and applications

When looking at the organisation as a whole, several registers are found linked to assets:

- The equipment asset register (described above) for physical assets is used by engineering to maintain assets.

- The financial fixed asset register is used by finance to report on assets (acquire, budget, depreciate, sell, etc).

- The geographic information system (GIS) register is used by engineering and finance to store the geographical information system, especially applicable to erfs, buildings, pipelines, electricity lines, roads, etc.

- A parts register is found in the store with all the parts which are registered on a physical asset’s bill of materials.

- The operational register outlines the responsibility per area, function or department.

So why not have only one register that combines all of these? Theoretically, it is possible. The question is whether it is feasible, practically implementable and indeed the optimal solution. To answer this question, let’s look at each stakeholder’s requirements and how the register is used. Any organisation dependent on assets will have various departments with different processes and requirements, all reporting on and registering the same assets.

The financial department has many divisions with unique requirements:

- Financial accounting is responsible for presenting the company’s historical financial view to management and shareholders and is audited against accounting standards. They will register and report on the acquisition of the asset, but only need to describe it adequately for reporting. One can, for instance, acquire a wastewater treatment plant and have it as one asset on the financial asset register as it was one transaction. When components or assets within it are sold, the financial asset register might need to be unbundled to accommodate this. Legislature like GRAP 17 guides the level at which an asset is registered closer to the engineering/maintenance view. The accounting function needs to value, depreciate and impair assets and constantly reflect the asset’s remaining useful life and residual value.

- Managerial costing provides a monetary reflection of business resources’ utilisation and related cause-and-effect insights into the past, present or future enterprise economic activities. Managerial costing aids managers in their analysis and decision making and supports the achievement of an enterprise’s strategic objectives.

- Management accounting aids with forecasting to facilitate management decision making. Together with managerial costing, they need to support plant expansion, upgrades, etc and need the correct data to inform it.

- Budgeting needs to track and report on budgets, often against assets.

- The financing department needs to budget for capital acquisitions, also linked to current or future assets.

The operational department will be concerned with the optimum availability and usage of their assets, the quality of the service/product, etc. They will often allocate resources in a certain way or form to assets or asset groups to ensure that they are well maintained and kept safe.

The maintenance department is responsible for maintaining an asset after it has been commissioned. This is done as per the asset management plan for that asset, including how it is acquired, operated, maintained, condition monitored, disposed of, etc. Maintenance plans need to be set up for each piece of asset and breakdowns logged against it.

The spares department (MRO stores) must ensure the optimal balance of the right amount of stock to provide in operational demand at all times. To fulfil their function, they need to break down assets into their maintenance spare parts and have these parts linked to supplier codes for optimal procurement processes.

A geographical information system (GIS) shows both the physical location of an asset and its exact size/boundaries. It is most often a loose-standing function that needs to keep track of constant changes to assets’ boundaries and locations.

Each of these departments has different requirements and views on what an asset is. The definition of an asset, according to ISO 55000, is not shared by the generally accepted accounting principles (GAAP) or the International Financial Reporting Standards (IFRS). Each department has systems that support its processes, with an asset register as the foundation.

Subdividing a piece of land would need to be supported by GIS but would have a limited immediate impact on the other registers. But at some point, it might have to get re-evaluated or sold, and then the change must be registered on the financial register. Operations might decide on new subdivisions of their operations with, once again, limited impact on several of the other registers. But upfront, OPEX would need to be realigned, and if management wants the total cost of ownership of an asset, it would have to be linked to maintenance expenses on this new grouping. An asset might be sold and removed from the engineering/maintenance register as maintenance will stop but will need be kept on the financial register because of a warranty claim or other requirement.

From this in-depth look at each stakeholder, we can conclude that different asset registers are not the enemy but rather the solution. The question is, how can an organisation ensure that these registers align where necessary and on what level? For instance, if maintenance inspects an asset, this could be a sufficient indicator of condition and subsequent remaining life as required by the accounting team. If the maintenance team’s inspection records does however not include information relating to remaining life, a separate project at extra cost will need to be conducted.

How to align asset registers

To align these registers, a key, link or tag needs to be inserted into the registers to connect them to each other.

ISO 55010 recommends that the following criteria be addressed with the key/link/tag’s inclusion:

- A common understanding is achieved of the specific asset’s captured data, reporting and analysis requirements across each functional area.

- Data that needs to be shared across the different functional areas is identified and defined.

- A single key source for each of the specific data elements is identified and agreed upon.

- Data quality standards, business processes, responsibilities and timelines for maintaining the asset register data have been defined and agreed upon by the different stakeholders.

Meeting these criteria will lead to common terminology and align maintenance and finance to agree that the engineering term “repair” be interpreted by finance as an expense, while “improve” be treated as capital expenditure. It will enable the financial department to report more accurately and efficiently. It will provide information that is aligned, reliable and useful for decision making, and it will assist each department in seeing and understanding their effect on another.

Staff must continuously be trained and reminded of this. ISO 55010 agrees that non-financial functions should understand financial and accounting principles for asset management to foster discussion and communication between different functional areas within an organisation. This leads to a better understanding of the terminology and language commonly applied by financial and non-financial staff relating to asset management.

Critical success factors of asset register alignment

For the successful alignment of asset registers and the whole asset management or information asset management deployment, top and middle management support are critical. Role players in the organisation are too close to their processes and reaching their objectives to take note and give support to other departments in the organisation. Awareness must be created of the bigger picture, other departments’ requirements and how much more efficiently and effectively the organisation can run if departments and processes cater to others’ needs. Interviews with asset management experts by the United States’ Government Accountability Office led to the conclusion that ” … silos are necessary to allow for the required level of specialisation, but if these silos do not communicate, inefficiencies and errors in asset management result”. Furthermore, ” … when asset management implementation fails, it is often because asset management staff and senior management are not in alignment”.

In closing

The focus should be on the alignment of asset registers, systems, terminology and people throughout the organisation. ISO 55001:2014, 7.5 d) states that “the organisation shall determine the requirements for alignment of financial and non-financial terminology relevant to asset management throughout the organisation”. An organisation that wants to improve must understand how critical efficiency, information accuracy to inform decision-making and shared understanding is for them to achieve their goals.